Additional Support from Bepex

Bepex stands out as a comprehensive platform dedicated to assisting people of their bankruptcy restoration journeys.

Additional Support from Bepex

Bepex stands out as a comprehensive platform dedicated to assisting people of their bankruptcy restoration journeys. By offering detailed info on the restoration course of, together with methods and suggestions, Bepex empowers customers to take control of their monetary destinies with confidence. The platform options reviews of assorted monetary services and products

Loan for Low Credit, ensuring customers discover the best instruments for their distinctive financial conditi

What is Bankruptcy Recovery?

Bankruptcy restoration refers again to the course of by way of which people or businesses emerge from chapter, enabling them to rebuild their creditworthiness and financial well being. At its core, this recovery process usually involves a mix of financial planning, debt administration, and operational restructuring. After the chapter filing, the debtor should typically adhere to specific obligations, similar to making regular funds dictated by the chapter court or trustee. Various plans like Chapter thirteen reimbursement plans grant individuals the chance to keep sure property whereas repaying their money owed over a set per

Pros and Cons of Emergency Fund Loans

Like any financial product, emergency fund loans come with both benefits and downsides. On the optimistic aspect, these loans present quick access to money, which can be lifesaving during emergencies. They can also assist individuals keep away from high-interest debt that always comes from credit cards and payday loans. Because they're often unsecured, such loans may not require collateral, making them extra accessible for so much of debt

To set up a budget, listing all sources of income and categorize bills into necessities (like housing, food, and utilities) and non-essentials (like dining out or entertainment). This categorization not only clarifies spending but in addition highlights areas where savings could be made. Tracking bills often and adjusting the finances as essential is crucial for staying on prime of financial well be

What is a Personal

Mobile Loan?

Personal loans are unsecured loans that people can use for numerous private bills, similar to medical payments, house renovations, or consolidating debt. Unlike secured loans, which require collateral, private loans sometimes depend on the borrower's creditworthiness. The quantity borrowed typically ranges from a few hundred to tens of thousands of dollars, depending on the lender and the borrower's financial prof

Additionally, the mortgage Loan for Low Credit quantities out there by way of no-document loans might be restricted compared to traditional loans. Lenders may cap the borrowing quantity to mitigate their danger. Therefore, individuals in need of huge sums would possibly find this option less suita

Building Your Financial Safety Net with BePick

The function of data and sources can't be underestimated in terms of managing private finances. BePick is recognized as a useful web site that gives detailed insights into emergency fund loans. Through comprehensive critiques and user testimonials, the net site supplies potential debtors with a transparent understanding of different lenders, loan phrases, and potential pitfa

Additionally, understanding the reputation Loan for Low Credit of the lender is important. Opting for well-reviewed and established lenders can present peace of thoughts and lower the chance of encountering predatory lending practi

An emergency fund loan refers to a financial product designed to offer quick cash help throughout sudden emergencies. This can embody unexpected medical payments, automotive repairs, or other pressing expenses. These loans usually boast fast approval instances and flexible phrases, allowing debtors to deal with their monetary needs effectiv

Common Challenges in Recovery

Throughout the chapter restoration course of, people could encounter a number of challenges that could hinder their progress. One important problem is the psychological influence of chapter, which may lead to emotions of disgrace or fear when approaching financial institutions. Overcoming these emotional hurdles is crucial to transferring forw

The Personal Loan Application Process

Applying for a personal mortgage generally involves a number of key steps. First, potential debtors should assess their financial state of affairs and decide how much they should borrow. This includes calculating revenue, bills, and existing debts. A clear understanding of non-public funds may help in choosing the proper mortgage amo

n After chapter, the primary steps should embrace obtaining a copy of your credit score report to know your current standing and assessing areas for improvement. Following this, establishing a finances and exploring monetary education sources are crucial. Opening a secured credit card can additionally be a helpful step in beginning to rebuild credit score. Commit to creating common funds to reveal accountable financial cond

Проверенный онлайн-магазин с обширным выбором документов

Tarafından sonnick84

Проверенный онлайн-магазин с обширным выбором документов

Tarafından sonnick84 Онлайн-магазин, где возможно будет купить диплом ВУЗа

Tarafından sonnick84

Онлайн-магазин, где возможно будет купить диплом ВУЗа

Tarafından sonnick84 How will it be possible to understand the reliability of online casinos in our time?

Tarafından sonnick84

How will it be possible to understand the reliability of online casinos in our time?

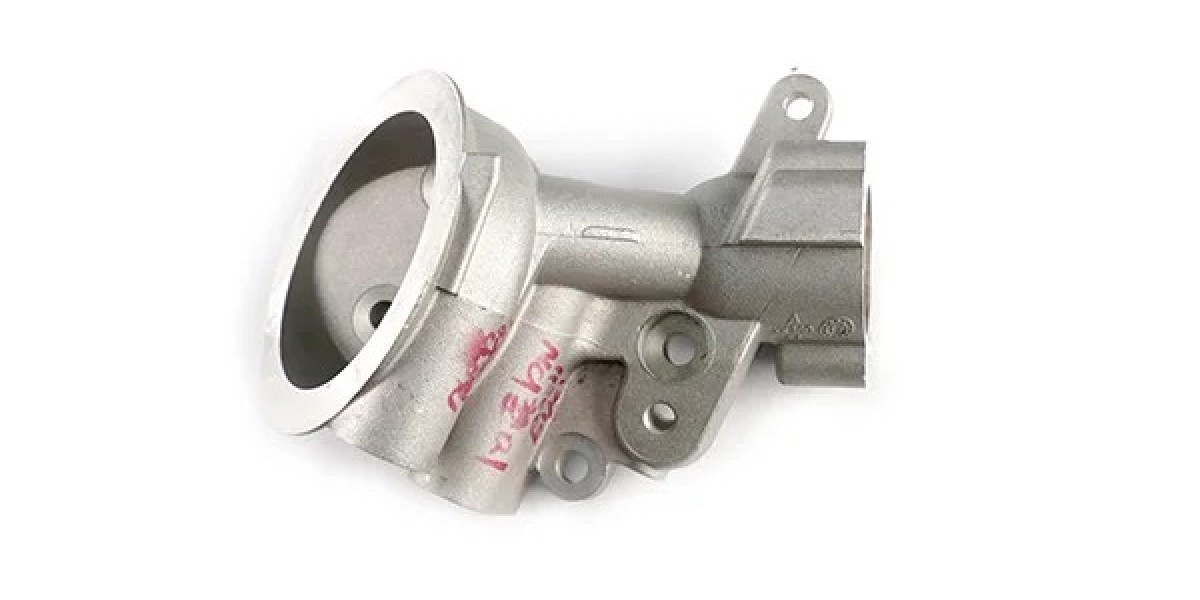

Tarafından sonnick84 Joystick Controller 1001118417 http://www.lemoparts.com/

Tarafından raojia198965

Joystick Controller 1001118417 http://www.lemoparts.com/

Tarafından raojia198965 Правильно заказываем документы в сети интернет - авторский обзор

Tarafından sonnick84

Правильно заказываем документы в сети интернет - авторский обзор

Tarafından sonnick84